17 Jun Business success or failure – the impact of the person at the top… Clued Up investigates

Issue 3 – June 2019

Jamie Oliver’s restaurants vs Wetherspoons – a leadership-style comparison

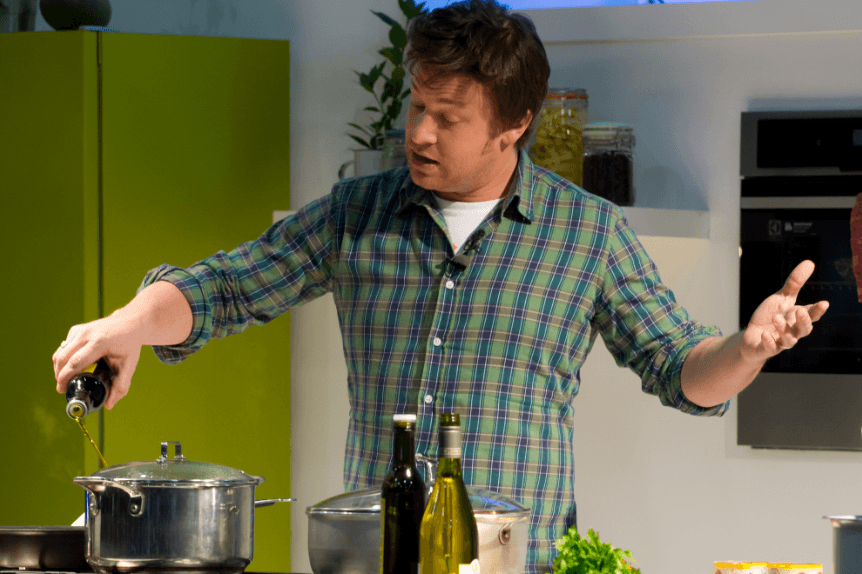

It’s a personal brand that has been second to none. Since a fleeting appearance on a BBC documentary more than two decades ago, Jamie Oliver has established himself as one of the best-known faces on British television, his enduring popularity forming the springboard for a range of diverse business ventures.

Share on facebook

Facebook

Share on twitter

Twitter

Share on linkedin

LinkedIn

Share on pinterest

Pinterest

But on May 21 2019, the collapse of Oliver’s restaurant business – including Jamie’s Italian, Fifteen and Barbecoa – provided a stark reminder that in an increasingly tough and competitive industry, the strength of a personal brand is no guarantee of survival. Indeed, if the key to business success is attention to detail and an ability to keep at least one eye constantly focused on a rapidly moving market, the diversity of Oliver’s interests may have been part of the problem.

Some sort of crisis was probably inevitable. In 2017, Oliver’s restaurant business – not including Fifteen – rang up a loss of £29 million, following hard on the heels of a £9 million deficit in the previous year. And while the business had been profitable between 2009 and 2015, losses over the period 2011 – 2017 amounted to almost £19 million.

So how did an apparently healthy business, founded and fronted by a popular and trusted TV chef, lose its way?

The strength of a personal brand is no guarantee of survival. In 2017, Oliver’s restaurant business – not including Fifteen – rang up a loss of £29 million

A range of causes can affect business outcome

There are undoubtedly a great many contributory causes. Some – such as high commercial rents and the level of local taxes levied on high street businesses – are outside the control of management. But while these factors have indeed contributed to a hollowing out of our town and city centres, they tend to affect businesses that are already facing problems.

Competition and positioning are certainly also factors. Since Oliver’s restaurants went into administration, analysts and food critics alike have noted a disconnection between quality and price. The argument is that the Jamie’s Italian chain in particular was too expensive for the casual dining market and not unique enough in terms of food quality and the overall experience to attract customers who were prepared to pay more. Some food critics stated bluntly that the quality of food on offer could be poor in some outlets. This suggests a management issue.

Turnover (£m)

Profit/Loss (£m)

Did management issues undermine Oliver’s businesses?

” Tim Martin, Wetherspoon’s Chairman, visits 60 of his pubs each month”

Scaling up a business is not easy. A team managing a single restaurant will – or should – lavish a huge amount of attention on getting all aspects of the customer experience right, along with the business model. Maintaining the same standards across 20 or more outlets is much more challenging. So there is a question here. Did Oliver’s management team have the necessary skills to run multiple restaurants cost-effectively while meeting the expectations of diners? And did Oliver himself

have the necessary business acumen to oversee the operation while also involved with a host of other activities? Certainly, there have been question marks over his choice of family members to run parts of his business.

Tellingly perhaps, figures posted by the Oliver restaurant chain demonstrate that the business struggled to match rising sales with profit. In 2008, the business reported turnover of £3.7 million, rising to £100m in 2017. However, while restaurants in the chain made a collective profit of £1.17 million on a turnover of £19.4 million in 2009, fast forward to 2014 and sales of £116 million generated a profit of just £2.7 million.

In fairness, Jamie’s restaurants were generating profits of more than £5 million on similar turnover a few years earlier and that, perhaps, suggests that a hostile high street environment was partly to blame for the loss of more than 1,000 jobs.

Did Oliver himself have the necessary business acumen to oversee the operation while also involved with a host of other activities? In 2014, sales of £116 million generated a profit of just £2.7 million.

The Weatherspoon way of running a business

So let’s compare and contrast. Operating in the same environment, the Wetherspoon pub/restaurant chain has maintained high and healthy levels of profitability. For instance, in 2011 Wetherspoon reported a £96 million profit on turnover of £1.1 billion. Figures for 2018 show sales of £1.7 billion (up 55% from £1.1 billion in 2011) and produced a profit of £132 million.

They are, of course, different businesses, but they both sell food and drink and there is an interesting comparison to be made between their respective figureheads. It’s doubtful if too many of Wetherspoon’s customers are aware of founder and chairman, Tim Martin. He has raised his public profile to a degree through his vocal support for Brexit, but, by and large, the branding of the chain stems from the experience it offers, rather than the founder’s profile. Affectionately known as “the Spoons” the business has a strong brand that appeals directly to its target demographic.

Tim Martin regularly visits pubs in the 1,000-strong chain – 600 a year, according to reports.

It can be no coincidence that Martin has been a hands-on leader and instrumental in building that brand. He regularly visits pubs in the 1,000-strong chain – 600 a year, according to reports. He usually parks a mile away, walks to the pub, arrives unexpectedly, samples the food and service – and talks to the staff and customers. When action needs to be taken to sort out a problem, he makes sure that happens. Trained as a lawyer, he is very much a details man – essential when running a complex business.

Those attributes have also been instrumental in building a business that employs 38,000 staff (up 60% from 24,000 at the start of the decade), with a cash reserve of £63 million.

I wonder how much time Jamie Oliver spent in and on his restaurant business, especially during the last three years when the alarm bells were ringing?

Wetherspoons employ 38,000 staff (up 60% from 24,000 at the start of the decade), with a cash reserve of £63 million, and has has clocked up almost £900 million in profits on sales of £11.5 billion since 2011.

If there is a message here, it is simply that Britain’s high streets and town centres are undoubtedly facing major problems – difficulties that have resulted in a wave of retail and hospitality industry closures – but the best-run companies have continued to flourish. Wetherspoon’s, for instance, has clocked up almost £900 million in profits since 2011 on sales of £11.5 billion.

Management experience and expertise play a crucial role. That’s not just about being an inspirational or focused leader. It’s also about building teams and delegating responsibility to those with the right blend of skills. Crucially though, it is up to the man or woman at the top to stay connected to the business in terms of its operations strategy and how it is being affected by market changes.

Crucially though, it is up to the man or woman at the top to stay connected to the business.

Share on facebook

Facebook

Share on twitter

Twitter

Share on linkedin

LinkedIn

Share on pinterest

Pinterest

Categories

Can AlertBI help with your data insights?

Most of the information listed below is not readily available in any other data analysis software system. Many of the sectors, sub-sectors and companies we profile will be completely under your radar yet have turnovers and profits counted in millions. Our software enables you to:

- Find out which sectors are either stagnant, shrinking fast or growing and whether they need to move their company in or out

- Instantly see where the fastest –growing or declining businesses are located in the UK and if they need to move or withdraw from those areas

- Compare companies in different sectors and which ones have the largest turnovers or the smallest profits

- Look at the activities of a client or competitor over a period of time and see how many employees they’ve recruited or lost, if they’re about to open new branches or about to close existing ones

- Take the features of a company’s best clients and find ‘clones’ of them, perhaps in other sectors or regions, so the organisation can utilise and roll out existing operations across production, transport and/or services

- Discover whether other firms are extending into that company’s area of operation or how their competitors are doing.

- Become an expert adviser in a given field by using fresh data to create their own publications, business advice, and proof of expertise.

AlertBI’s investment in cutting-edge data systems technology

Alert Data, our constantly updated data hub, contains 100 million pieces of information on 500,000 UK organisations and can be used as easily as a Google search engine, 24/7. The data contained can be diced and sliced to the user’s exact needs across 21 sectors; over 100 sub-sectors; locations by nation, region, town, city and post code; detailed contact types; and company details, such as performance, size, turnover, and profits.

The Alert Data online service is one of the most innovative data analysis software systems available anywhere. Find out more at alertbi.com or give me, Ray Murphy, a call on 07814 770621.

Want to learn more about the companies or this sector?

Sign up for Clued-Up now:

Clued-Up is a regular free publication delivering unreported stories. We interpret business data and insights, spotting trends as well as opportunities and threats, pinpointing upcoming new firms and those that are struggling or static.

We then deliver the information in a digestible and meaningful way so that it can be acted upon.

If you would like to receive Clued-Up articles on a regular basis, register your interest here.

Clients we have worked with

We work with organisations of all sizes in the public and private sectors, ranging from start-ups and sole-traders to SMEs and global organisations, including Barclays, Mars, Trinity Mirror, The Bank of England, Google and Hays.

No Comments